oklahoma auto sales tax rate

The sales tax rate for the Sooner City is 45. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

. 5513 Luther 3 to 4 Sales and Use Increase October 1 2021 0114 Stillwell 35 to 375 Sales and Use Increase October 1 2021 3388 Jackson County 0625 to 1125 Sales and Use. This is the total of state county and city sales tax rates. Until 2017 motor vehicles were fully exempt from the sales tax but under HB.

In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle. There are special tax rates and. The Motor Vehicle Excise Tax on a new vehicle sale is 325.

The county the vehicle is registered in. Oklahoma has recent rate changes Thu Jul 01 2021. Motor vehicle excise tax.

The state sales tax rate in Oklahoma is 4500. Oklahoma has a graduated individual income tax with rates ranging from 025 percent to 475 percent. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

What is the sales tax rate in Oklahoma City Oklahoma. The Oklahoma state sales tax rate is 45 and the average OK sales. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Now Oklahomans purchasing a vehicle will have to pay a 125 percent tax on top of the 325 percent excise tax. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426 on.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Content updated daily for oklahoma sales tax rate. Oklahoma has a 450. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

The Motor Vehicle Excise Tax on a new vehicle sale is 325. This is the largest of Oklahomas selective. 325 of ½ the actual purchase pricecurrent value.

Effective May 1 1990 the State of Oklahoma Tax Rate is 45. The minimum combined 2022 sales tax rate for Oklahoma City Oklahoma is. Oklahoma has state sales tax of.

How much is Oklahoma sales tax on a car. 325 of taxable value which decreases by 35 annually. Counties and cities can charge an.

Exact tax amount may vary for different items. With local taxes the total sales tax rate is between 4500 and 11500. Check prior accidents and damage.

Oklahoma also has a vehicle excise tax as follows. The sales tax rate for the Sooner City is 45. In Oklahoma localities are allowed to collect local sales taxes of up.

Oklahoma also has a 400 percent corporate income tax rate. Average Sales Tax With Local. Businesses can check the Oklahoma Tax Commissions page for new and updated lodging taxes.

Used Cars And Trucks For Sale In Okc Bob Moore Auto Group

Oklahoma Who Pays 6th Edition Itep

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Oklahoma City Tax Title License Fees

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

States With The Highest And Lowest Sales Taxes

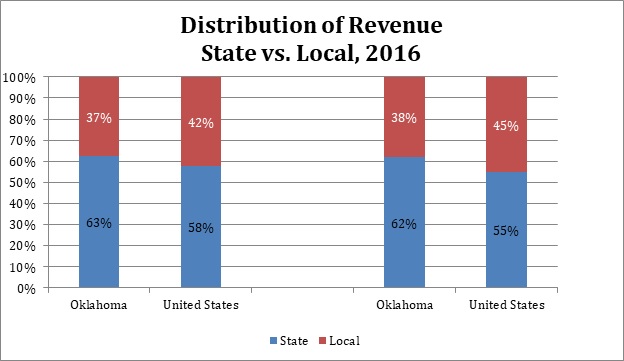

State And Local Tax Distribution Oklahoma Policy Institute

Tesla Asks Fans In Oklahoma And Mississippi To Fight New Bills To Ban Direct Sales Of Electric Cars Electrek

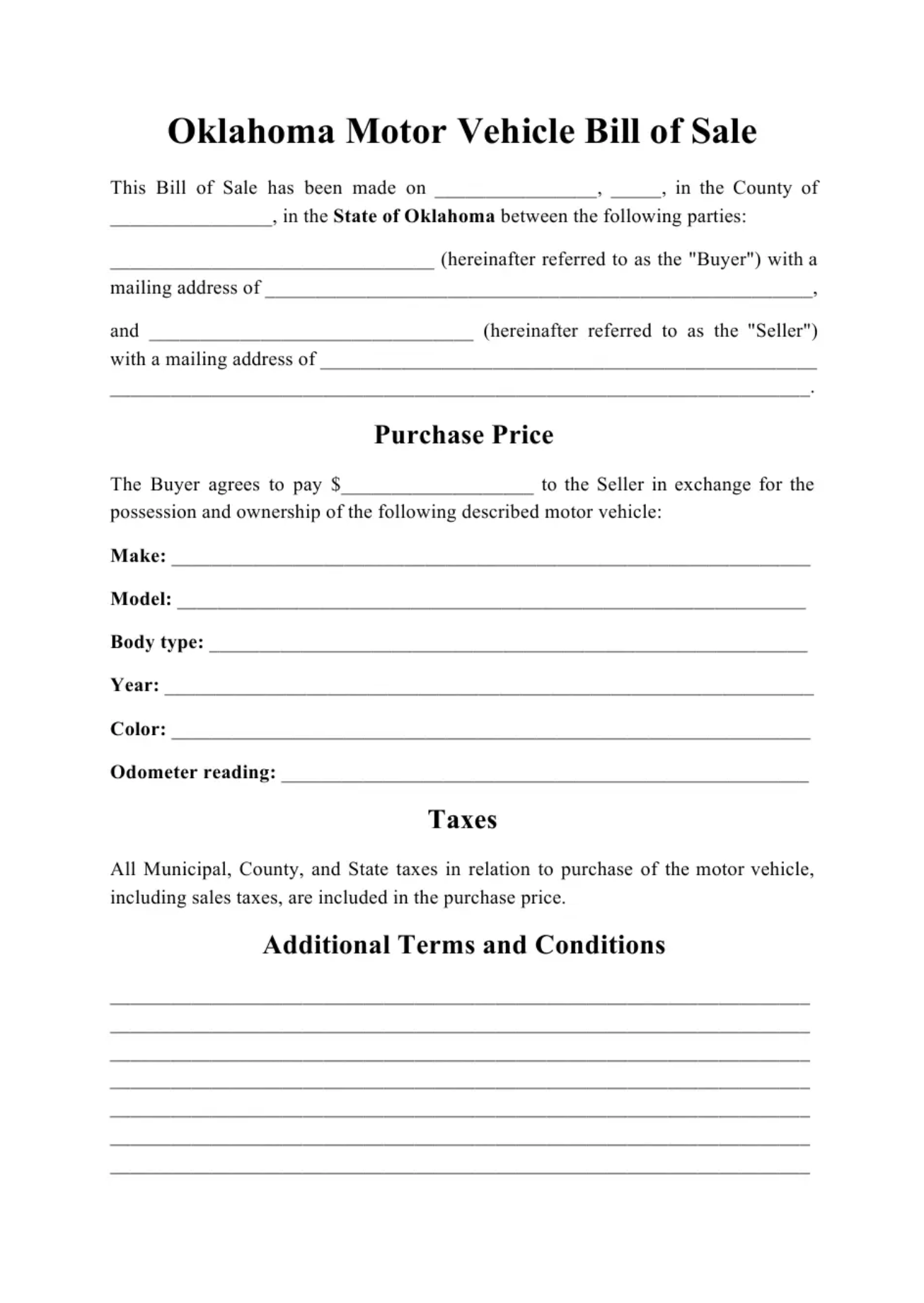

Get Oklahoma Auto Bill Of Sale Form Usedautobillofsale Com

Oklahoma Sales Tax Calculator And Local Rates 2021 Wise

State Income Tax Rates Highest Lowest 2021 Changes

Bob Moore Ford New And Used Dealer In Oklahoma City Ok