utah non food tax rate

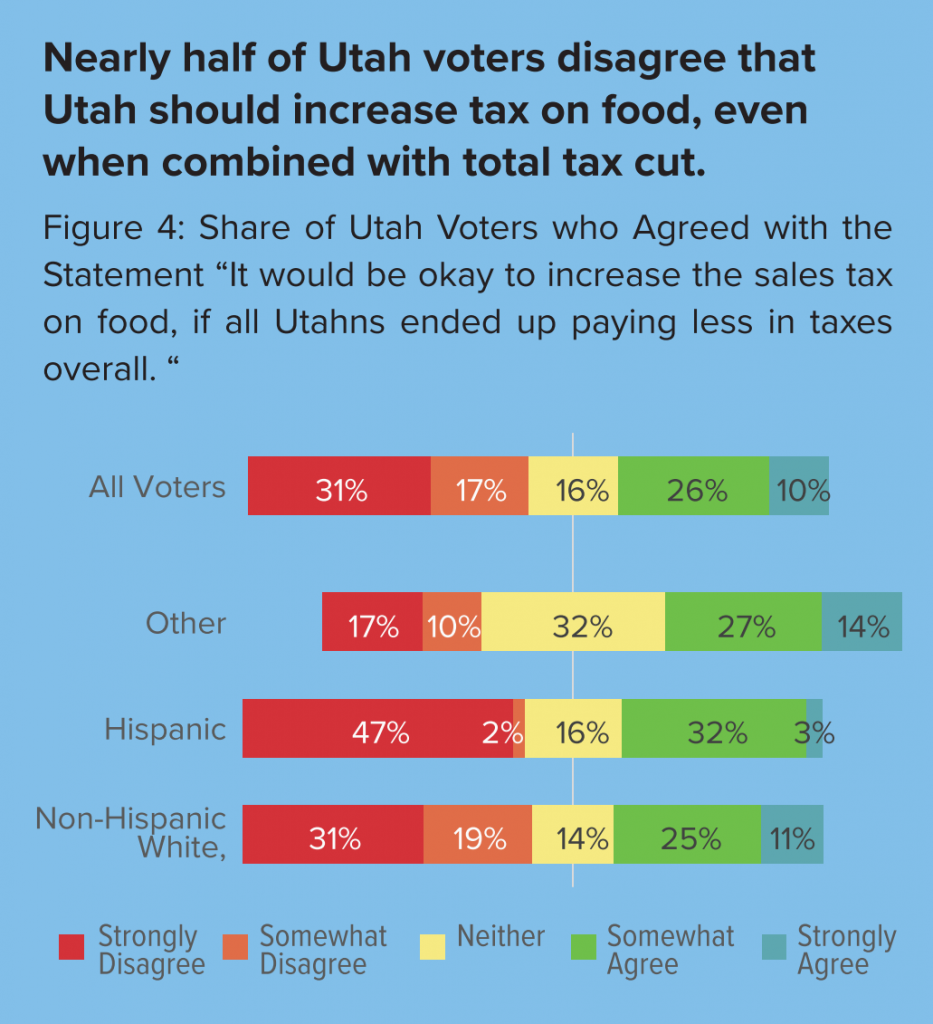

But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong. 100 East Center Street Suite 1200 Provo Utah 84606 Phone.

Utah Llc How To Start An Llc In Utah In 11 Steps Starting Up 2022

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

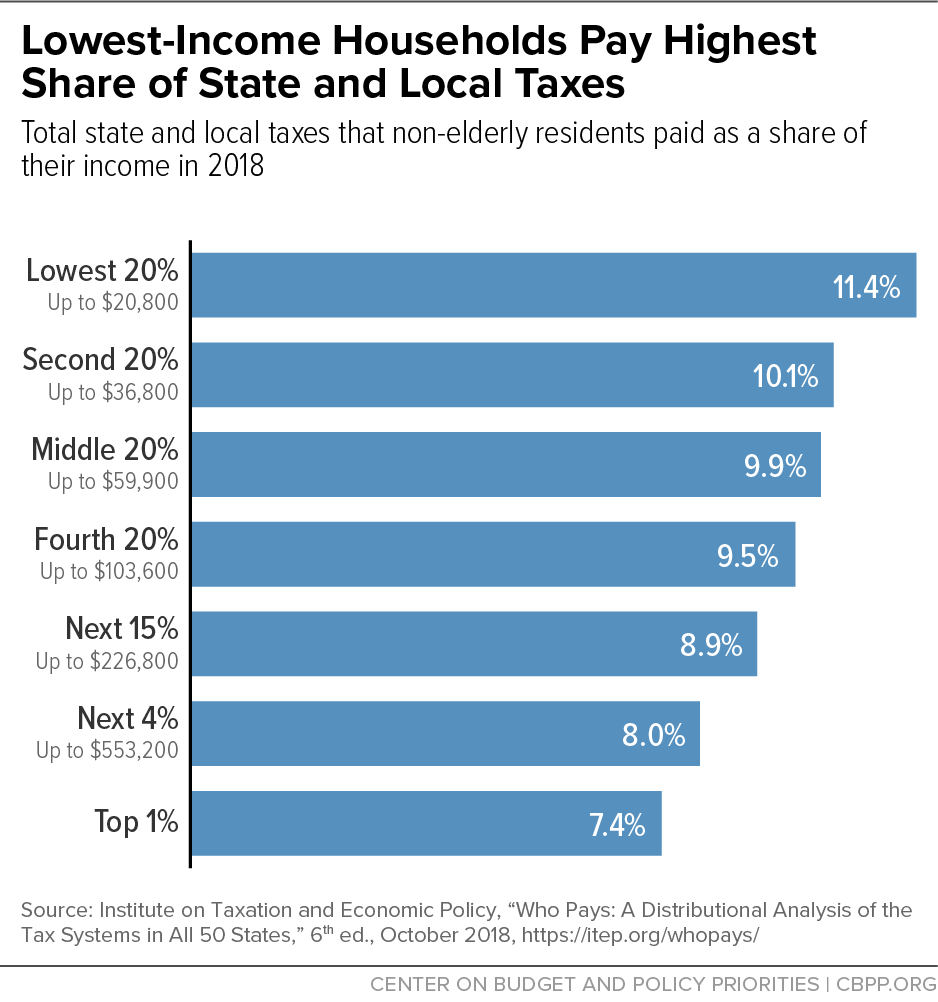

. Depending on local jurisdictions the total tax rate can be as high as 87. What is the non food tax in Utah. Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families.

January 1 2022 current. January 1 2008 December 31 2017. Utah specifies that prepared food is considered ready to eat or sold with utensils.

Exact tax amount may vary for different items. January 1 2018 December 31 2021. Detailed Utah state income tax rates and brackets are available on this page.

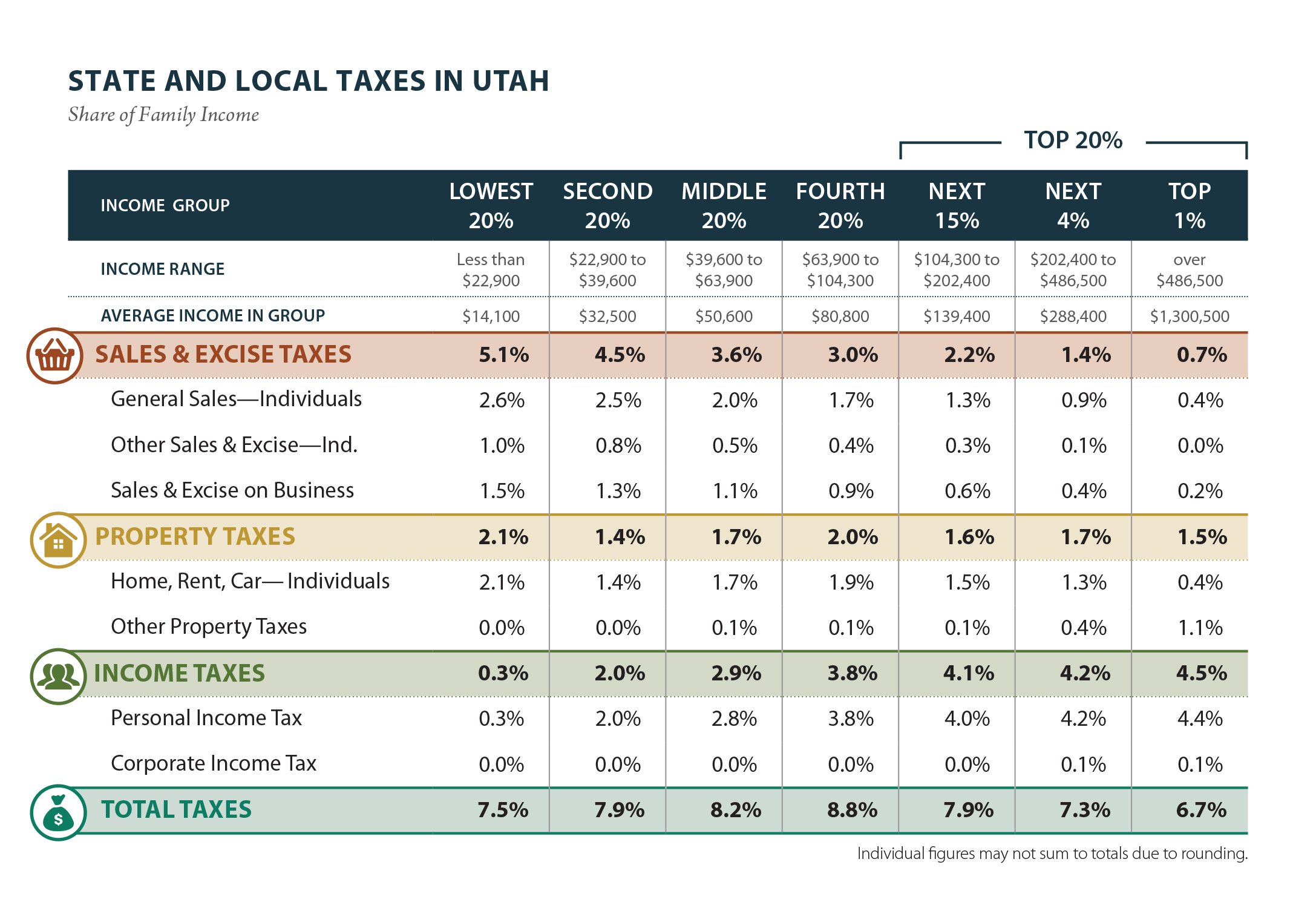

Are meals taxable in Utah. The Utah LLC tax rate matches that of the rest of the state at 5 percent because there is a statewide flat income tax rate. Monday - Friday 800 am - 500 pm.

Tax years prior to 2008. The Utah UT state sales tax rate is 47. According to the US.

271 rows Average Sales Tax With Local6964. Prepared food in Utah is considered taxable. Utah has state sales tax of 485 and.

2022 Utah state sales tax. Income tax payments come in around the national average for. It disproportionately hurts low-income Utahns and.

Like lotteries state taxes on food amount to. The Utah income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022.

Utah Who Pays 6th Edition Itep

If We Don T Charge Sales Tax On Food What About Other Necessities

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Moving To Utah A Guide To The Beehive State Neighbor Blog

State Individual Income Tax Rates And Brackets Tax Foundation

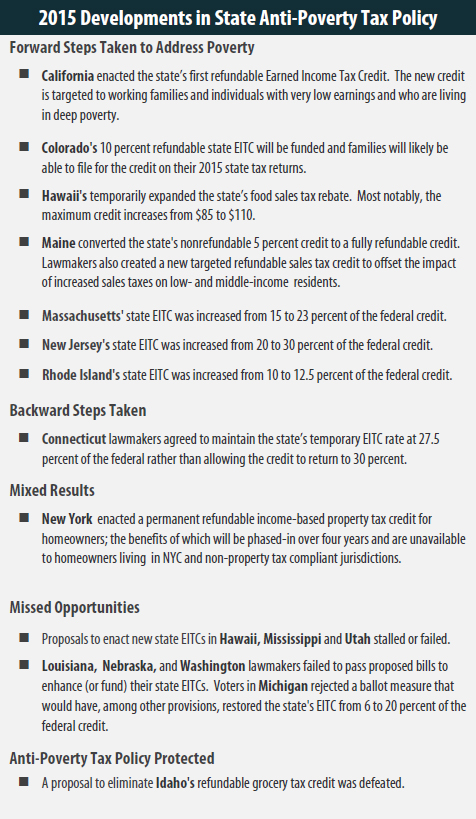

State Tax Codes As Poverty Fighting Tools Itep

Everything You Need To Know About Restaurant Taxes

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Everything You Need To Know About Restaurant Taxes

Sales Tax Amnesty Programs By State Sales Tax Institute

Utah Should Stop Taxing Groceries Completely Opinion Deseret News

What Is Sales Tax A Complete Guide Taxjar

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes